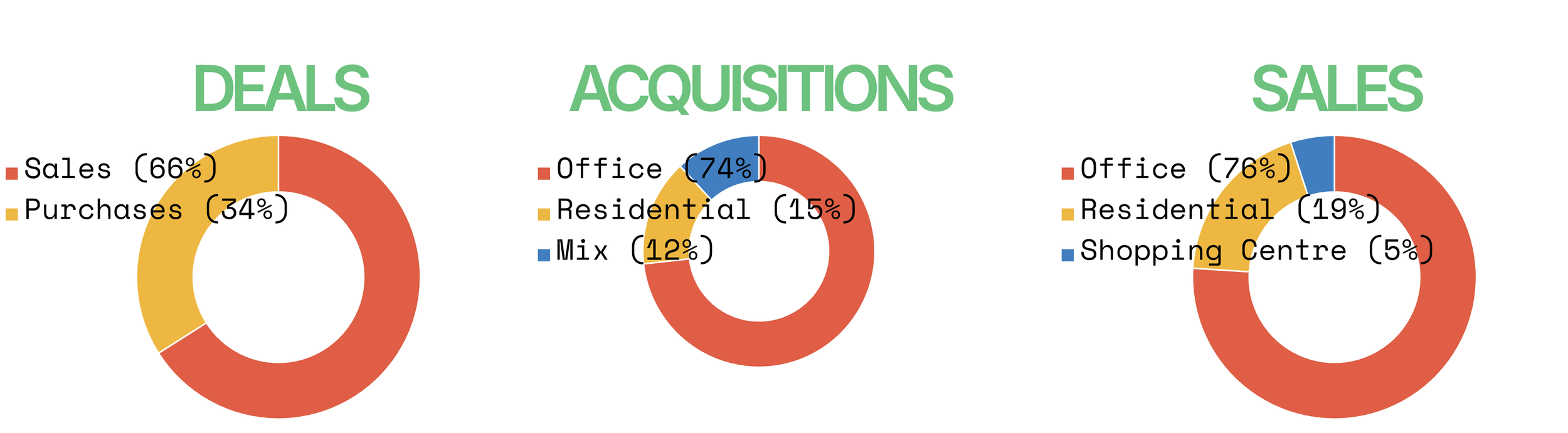

€2bn +track

since 2011

-

Our expertise includes guidance on recalibrating existing SPVs into alternative structures which allow new LPs to enter into the dynamic.

-

With a track record exceeding €2BN since 2011, we have led corporate initiatives across the full company lifecycle—from acquisition and restructuring to exit. As Dry Capital tracks both equity and debt markets, we can guide investors where they should align their strategies for the new markets.

-

With a deep understanding of market cycles and strategic repositioning, our expertise includes the identification of opportunities from core and opportunistic markets in hybrid capital venture deals in asset backed synergies.

-

Success lies in knowing when to act therefore we run curated capital raise processes to a wider market from local to international LPs looking to enter or re-enter the European markets.

ABOUT OUR FOUNDER:

Sheelam Chadha

Sheelam Chadha is a seasoned real estate investment professional with 20 years of experience across Europe. Before founding Dry Capital, she held senior roles at Savills, Patrizia, IVG, and Atenor, overseeing transactions exceeding €2 billion across office, residential, logistics, and retail sectors as well as management positions. Born in Canada and holding Canadian, British, and Belgian nationalities, Sheelam blends global perspective with local insight. She co-founded the KU Leuven Private Equity Real Estate course, bridging academic theory with real-world investment practice.Her leadership reflects a balance of strategic vision, analytical precision, and a genuine curiosity about people and places — values that define Dry Capital’s approach to real estate.