news

Upcoming events

-

Expo Real 2025

We will be present at Expo Real in Munich, Germany October 2025, meeting with partners and representatives around Europe.

See you in München!

-

PERE Americas NOV 4-5 2025

Dry Capital will be speaking at the 20th annual PERE America Forum in New York City, November 4–5, 2025.

Join 1,400+ global real estate leaders as we explore market shifts, distressed assets, and U.S. investment strategies.See you in NYC!

-

PERE EUROPE june 10-11 2025

Dry Capital will be speaking at the PERE Europe Forum on its 20th anniversary, which takes place on 10-11 June 2025 in London. Join us to discuss investing strategies in key global markets and learn how capital allocations to the asset class are changing at the Equity Track panel.

See you in London!

Dry Capital Expands into Iberia with Lake Capital Partnership

Brussels, Madrid: January 7th, 2026Female Duo Launch Cross-Border Partnership to Tackle Europe's Capital Gap

Founders shared PATRIZIA and IVG backgrounds connect Iberian real assets to European and international capital

The alliance expands Dry Capital into Southern Europe, with the ex Managing Director of DeA Capital, María Laguna

Dry Capital, a Brussels-based capital boutique specialising in equity raises and recapitalisations, and Lake Capital, a Madrid-based real asset advisory firm focused on primary investments and asset management, today announced a strategic partnership to serve institutional and private asset owners across the Iberian Peninsula.

The partnership launches at a critical moment: Dry Capital is currently mandated on numerous capital raises across key European markets, reflecting the immense demand for equity and debt solutions in today's constrained financing environment. The Lake Capital alliance extends this capability into Iberia, one of Europe's most active real estate markets.

The alliance brings together complementary capabilities: Lake Capital's expertise in sourcing, underwriting, and managing assets across Southern Europe, combined with Dry Capital's specialisation in equity and capital solutions. Where Lake Capital identifies opportunities and manages assets, Dry Capital provides the execution needs for new capital. Beyond European capital sources, the partnership is actively introducing North and South American investors to Continental European opportunities, with particularly strong demand from Latin American institutions seeking exposure to Western Europe. Spanish investors also benefit from the partnership's expanded reach into Northern European markets.

An Equity Innovation Platform

Founded in March 2025, Dry Capital was born from a clear market need identified by Chadha after nearly two decades working on the primary side as both institutional investor and developer.

"After years of deploying capital into new acquisitions and developments, it became evident that existing structures across Europe increasingly need recapitalisation solutions," said Chadha. "Dry Capital exists for one purpose: to solve the recap needs of operators or owners -whether for new deals, new strategies or recaps of existing situations. There has been a huge demand from all types of European owners on all fronts."

The firm focuses exclusively on asset-backed strategies, spanning all real estate asset classes as well as operational strategies. This broader scope reflects evolving market demands, as asset management-related capital needs have become increasingly complex in light of today's letting markets.

In its second phase, Dry Capital plans to launch a dedicated recap vehicle to complement its advisory activities with selected partners.

Lake Capital was founded by María Laguna after having successfully established DeA Capital in Iberia. She identified the opportunity to create an agile, independent firm capable of integrating advanced technology and data-driven tools into traditional real estate management models. The firm is conceived to bridge strategic vision with flawless execution, leveraging in an extensive senior-level network of operators, advisors, and industry specialists, facilitating efficient execution and the successful closing of complex investment opportunities.

“When you've both led transactions at firms like PATRIZIA and IVG, you develop an intuition for what institutional capital requires. María and I share that foundation. I spent fifteen years on the primary side – acquiring, developing, managing and deploying. But the market has fundamentally changed since 2020. Today my work is behind the scenes: finding solutions for structures that need fresh capital. That's the gap we're filling together”.

Sheelam Chadha, Founder, Dry Capital

Shared Institutional Heritage

Both female founders bring extensive institutional real estate backgrounds as former Heads of Transactions, having combined deals of over EUR 4 billion in transactions across European markets. Notably, both held senior positions as heads of respective transaction teams at PATRIZIA, TRIUVA & IVG, providing a shared understanding of institutional standards and investor requirements.

London-born Sheelam Chadha, 44, Founder of Dry Capital, served as Head of Transactions at PATRIZIA for the Belux region, following a decade in transaction roles at IVG and TRIUVA. She began her career real estate career as Head of Research at Savills in 2007 and spent three years as Country Director Belgium at Atenor, a listed European developer, until early 2025. She co-founded the ongoing Masters "Private Equity Real Estate" course at Belgium's top-ranked university, KU Leuven. She holds three nationalities: British, Canadian, and Belgian and studied at London Guildhall University, Harvard Business School, and the London School of Economics.

Maria Laguna, Founder of Lake Capital, has over 25 years of experience in investment and asset management across Southern Europe on behalf of institutional investors. She has led primary acquisitions and asset management mandates at DeA Capital, PATRIZIA, TRIUVA, and IVG, spanning logistics, residential, office, retail, and hospitality sectors.

"Our clients need both expert asset management and access to capital - but these are distinct disciplines. Lake Capital excels at sourcing opportunities and managing assets; we don't do equity or debt solutions. Dry Capital does. This partnership means Iberian asset owners now have a complete solution: local expertise to identify and manage opportunities, with direct access to international institutional capital to fund them."

Maria Laguna, Founder, Lake Capital

Expanding Continental Coverage

The Lake Capital partnership marks the first step in Dry Capital's regional coverage model, designed to provide asset owners with local expertise backed by pan-European institutional relationships. Further partnerships across key Continental European markets are anticipated as the platform expands with ongoing discussions, particularly in Germany where demand is increasing in Europe's largest market.

26 June, 2025

CEO Weekly

“Perhaps because it takes a certain kind of effort to break through. But that’s exactly why we need to change the dynamic by creating space, raising visibility, and encouraging more women to step into these roles.”

6 June, 2025

business insider

Newly Launched Dry Capital Reports Strong Initial Momentum in European Real Estate Recap Market

April 26, 2025

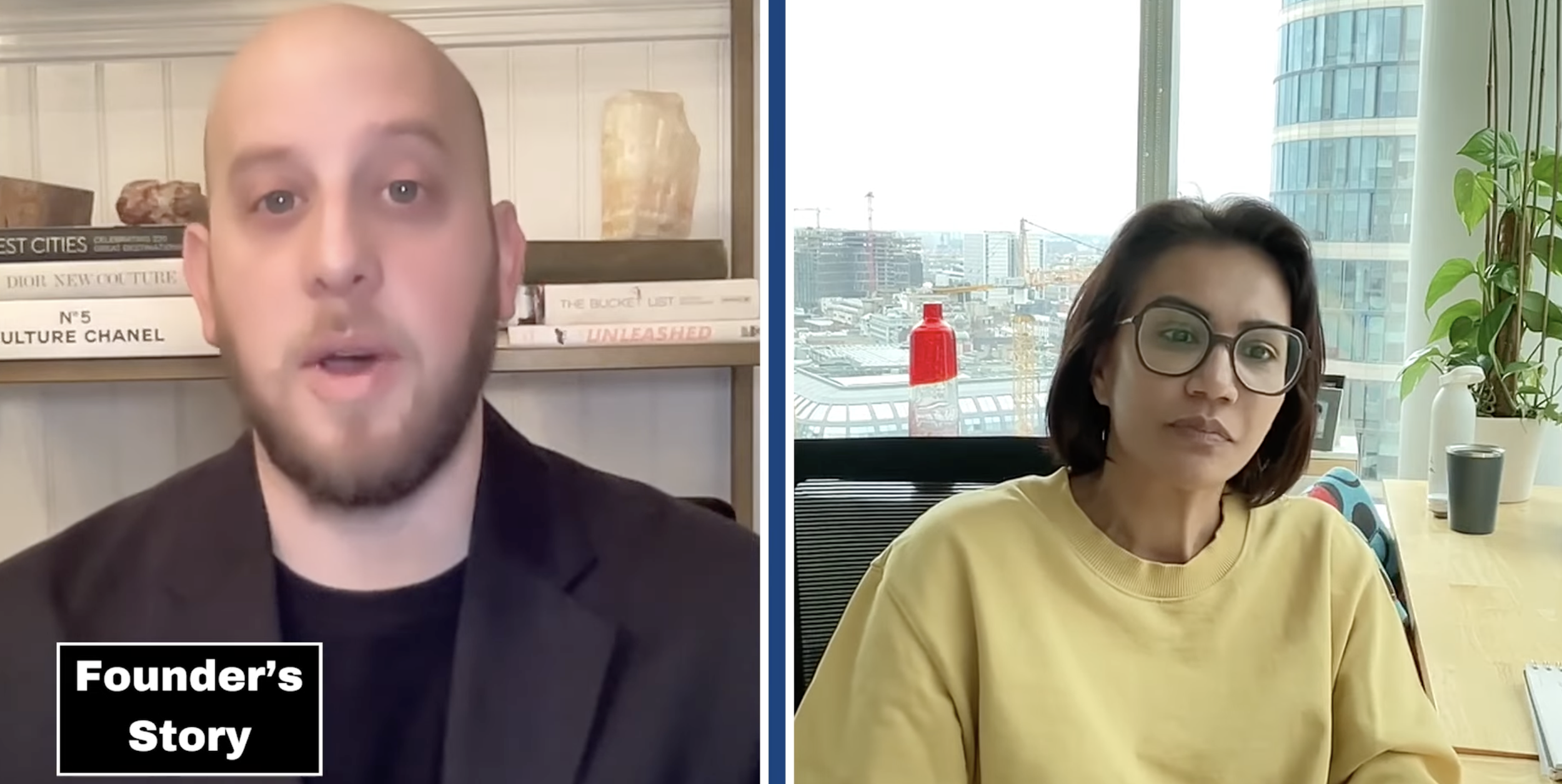

After 20 years in corporate real estate, Sheelam Chadha hit the ceiling — and walked away. In this powerful episode, she shares why she left a top job to launch Dry Capital, a firm reshaping commercial real estate in Europe. We talk about the economic storm ahead, the brutal truths about the industry, and what it really takes to build something on your own — especially as a woman in a male-dominated field. This is one of the rawest conversations we've had about risk, timing, and the price of conviction.