BLOG #7: Europe’s Capital Magnets

17 December 2025

European real estate continues to reprice. The correction is not over, political uncertainty across the EU remains elevated, and transaction volumes are uneven. Expectations that 2026 would deliver a clean, synchronized recovery have softened.

That environment has not eliminated opportunity. It has made it more selective.

Land values have corrected, development pipelines have thinned, and yield on cost is finally adjusting to levels that allow deals to clear again. For secondary equity and debt recapitalization providers, this means mid-to-high teens net returns, typically in the 15–18% range, are achievable in specific markets, provided underwriting is disciplined and structures are defensive.

Our view is not that markets will broadly “lift.” It is that certain cities are consistently producing investable deals today because sponsors in those markets have adjusted land values, reset return expectations, and accepted the new pricing reality.

London, Madrid, Paris, Berlin, Warsaw, and Luxembourg stand out. These markets combine repriced entry points, resilient occupier demand, and credible exit liquidity. As transaction activity normalizes unevenly, they are most likely to account for a disproportionate share of executable transactions.

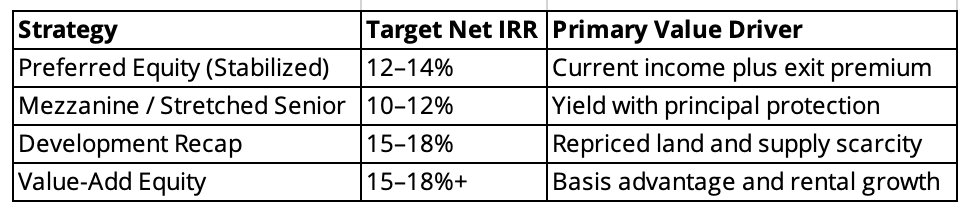

The Returns Thesis

The 2022–2024 correction reset the European development equation, but it did not resolve all uncertainty.

Across core European markets, land prices are down 15–25% from peak. Development starts have collapsed, with EU permit issuance down more than 20% year on year. Construction costs remain elevated but have stabilized. The result is not a rebound, but a return to underwriting logic.

Yield on cost finally pencils again.

For recapitalization providers entering the market today, returns are driven by basis, structure, and supply dynamics rather than broad market appreciation:

Sponsors who acquired land at peak pricing remain capital constrained. Many projects are stalled not because demand disappeared, but because capital stacks no longer clear. New capital entering today can underwrite mid-teens returns without relying on rapid cap-rate compression.

Across our target markets, yield on cost has expanded 75–150 basis points since 2022. That buffer is critical in an environment where exit timing remains uncertain.

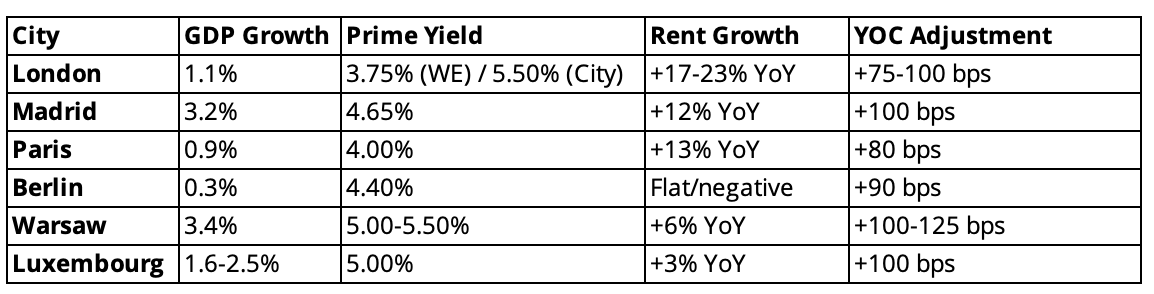

Key Market Metrics at a Glance

Sources: Cushman & Wakefield, CBRE, Savills, JLL, BNP Paribas Real Estate — Q1-Q3 2025 reports

Why These Six Markets?

These are not markets we expect to rebound uniformly or simultaneously.

They are markets where repricing has translated into execution rather than gridlock. Sponsors have written down land, recalibrated returns, and accepted lower leverage and longer holds. Where yield on cost has been reset, recapitalizations can move forward. Where it has not, deals remain frozen regardless of headline pricing.

That distinction explains the market selection.

As liquidity returns selectively, capital will concentrate where transparency, depth, and institutional demand already exist. These six cities meet those criteria today.

London: Repriced and Selectively Active

London offers a leading indicator of how the next phase is likely to unfold.

Land values outside prime core locations are down 20–25% from 2022 peaks. At the same time, the development pipeline has slowed sharply, with permits and starts at decade lows. This sets up future supply constraints.

Despite a challenging UK macro backdrop and ongoing fiscal austerity, selective primary activity is returning in London. This does not signal a broad recovery, but it does demonstrate that where pricing has reset and structures are realistic, capital can transact even in a constrained environment.

Target returns

15–17% net on development recaps

12–14% net on stabilized preferred equity

Key dynamics:

Office rents up 17% YoY through Q3 2025

Development pipeline down 40%+ from peak

Forecast yield compression of 40 bps through 2026

Deepest exit liquidity pool in Europe

Madrid: Growth with Adjusted Expectations

Madrid continues to combine strong fundamentals with a reset entry basis.

Spain’s GDP growth of 3.2% is driving occupier demand, while Madrid offers a 100–150 bps yield premium over Paris and London. Land prices corrected earlier and are now stabilizing, allowing underwriting assumptions to normalize.

Target returns

16–18% net on development and value-add

13–15% net on income-producing recaps

Key dynamics:

Land correction of 15% from peak

Rental yields averaging 4.8%, higher in peripheral zones

Foreign capital represents 72% of Spain’s inflows

Structural demand supported by Madrid Nuevo Norte

Paris: Lower Volatility, Higher Certainty

Paris has seen less dramatic repricing, but development economics have shifted.

Land is down 10–15%, construction costs have plateaued, and prime rents are growing more than 12% annually. Yield on cost expansion has restored feasibility to permitted projects.

This is not a high-beta market. It is a market where certainty and downside protection matter.

Target returns

14–16% net on development recaps

11–13% net on stabilized preferred equity

Key dynamics:

Sub-3% vacancy in core CBD

Severely constrained development pipeline

Strong flight-to-quality dynamics at exit

Berlin: TOUGH LOVE

Berlin remains one of the more challenging markets in Western Europe. Rental growth has stalled, regulatory complexity persists, and transaction volumes are subdued. The correction here has been deeper and slower to resolve than in other core markets.

And yet, Berlin is attracting significant attention from entry-focused capital.

The reason is simple: pricing. Berlin offers one of the widest entry discounts in Western Europe, with values 40–50% below Paris and London on a per-square-meter basis. For investors willing to underwrite through near-term uncertainty, the basis advantage is substantial.

Post-cycle deleveraging and ongoing capital constraints have created motivated sellers and recap opportunities that do not exist at the same scale elsewhere. Sponsors who acquired at peak leverage are now negotiating from a position of necessity rather than preference.

This is not a market for passive exposure. It is a market for structured capital that can tolerate complexity in exchange for entry pricing that may not persist once sentiment shifts.

Target returns

15–18% net on value-add residential

14–16% net on office repositioning

Key dynamics:

Land repricing exceeding 25% in secondary locations

Entry pricing at €6,200–8,000 per sqm

Institutional capital remains underweight German residential

Rental growth currently flat, but supply pipeline collapsing

Warsaw: Highest Return Potential, Higher Risk

Warsaw offers the highest absolute return potential among the six markets.

GDP growth of 3.4%, nearshoring tailwinds, and a housing deficit exceeding 1.5 million units support long-term demand. Land has repriced, but risk perception remains elevated relative to Western Europe.

Target returns

17–20% net on development

15–17% net on value-add

12–14% net on core-plus

Key dynamics:

Prime office yields at 5.00–5.50%

Yield on cost exceeding 7% on residential and logistics

Continued institutional appetite for Poland-focused exposure

Luxembourg: Stability with Structure

Luxembourg remains small but strategically essential.

As one of only ten AAA-rated sovereigns globally and the world’s second-largest fund domicile, it offers regulatory stability unmatched elsewhere in Europe. Despite its safe-haven status, current dislocation allows structured investments to achieve 15%+ net returns with strong downside protection.

Target returns

15%+ net on direct and structured investments

Key dynamics:

GDP growth projected at 2.5–3.2% through 2028

€14.7 trillion in UCITS and over €5 trillion in alternatives

Limited historical price volatility

Dry Capital Market Perspective

Across Europe, three themes are consistent.

First, repricing has enabled execution. Sponsors have adjusted land values and return expectations in certain markets, unlocking recapitalizations and transactions. In others, where yield on cost cannot be reset, deals simply do not happen.

Second, development supply is collapsing. Permit issuance is down more than 20%, and construction starts have fallen further. This will matter for assets delivered in 2027–2028.

Third, LP demand remains intact but selective. Investors want European exposure through structured strategies with visible cash flows and downside protection as well as credit-worthy sponsors. The six markets outlined above capture the majority of that demand.

Our 2026 Outlook: Selective Normalization

We no longer view 2026 as a clean turning point.

Instead, we expect selective normalization. Transaction volumes improve unevenly. Primary activity resumes first where pricing has adjusted and sponsors are capitalized. Returns are driven by structure and basis, not broad market beta.

London already illustrates this dynamic. Other markets are likely to follow at different speeds and scales.

The opportunity is not about timing a rebound. It is about positioning correctly while uncertainty persists.

The European real estate correction continues, and political and macro uncertainty remains a central concern for LPs.

That uncertainty has not removed opportunity. It has concentrated it.

London, Madrid, Paris, Berlin, Warsaw, and Luxembourg are not guaranteed outperformers. They are the markets where repricing has already translated into investable, well-structured deals, allowing recapitalization providers to underwrite 15–18% net returns with discipline.

The question is not whether to deploy capital, but how to structure exposure in an uneven recovery.

Political and macro uncertainty across the EU remains ever present and continues to shape LP decision-making. Allocation committees are not questioning whether opportunity exists. They are questioning timing, structure, and downside protection.