BLOG #5: How Many Euros Are Chasing Each Euro? The New Math of Real Estate Capital in 2025

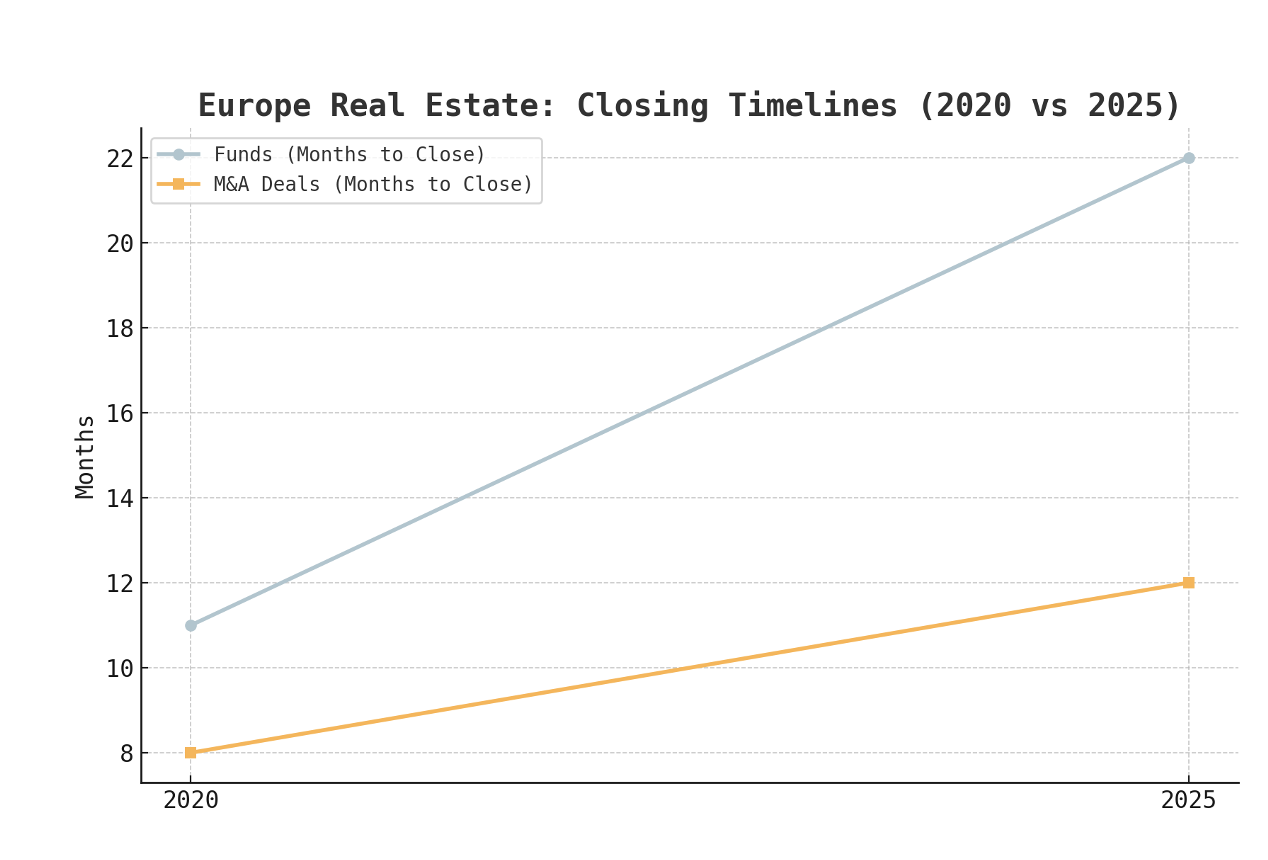

Five years ago, global real estate funds could wrap up in about 11 months. By 2024-25, the average has stretched to 21-22 months, the slowest pace on record according to PERE and PitchBook data. Investors are taking longer to re-up, forcing managers to spend nearly two years on the road compared to less than one before the pandemic.

Figure 1. Global Fundraising: Funds Closed vs. Months to Close (2020 vs 2025)

The Shrinking Pool of Funds

In 2020, roughly 600 global real estate funds closed, raising more than $250bn. By 2025, closer to 250-300 funds are closing, with about $120-140bn raised (PERE fundraising reports). While fewer funds are making it over the line, those that succeed are larger. Translation: for every euro investors want to deploy, there are about half as many funds competing as there were five years ago.

Secondary Market Surge

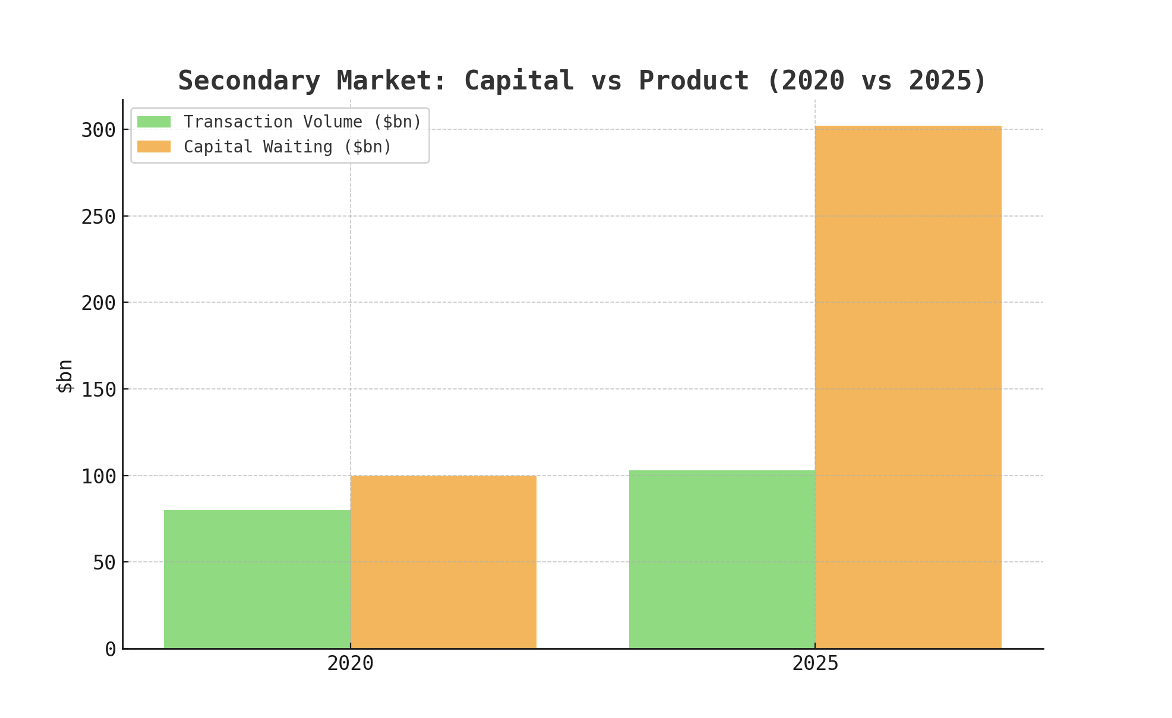

Where primary fundraising has slowed, the secondary market has surged. Global secondary transaction volume jumped 51% to $103bn in the first half of 2025, with a record $302bn in capital waiting to be deployed, according to Jefferies data reported by Bloomberg. That translates into a 3:1 ratio of capital chasing product - the opposite dynamic of primary fundraising.

In the primary market, investors commit new money to fresh real estate funds — capital that then takes months or years to be deployed into projects.

By contrast, the secondary market is the resale market:

· LP-led secondaries: institutions like pensions, insurers, or family offices sell their stakes in existing funds.

· GP-led secondaries: the sponsor (developer, owner, or fund manager) recapitalises an existing vehicle, extending its life or spinning assets into a new structure. This allows early investors to exit while bringing in new equity to support projects.

For real estate, the secondary market matters because capital is deployed faster, is often secured at a discount, and is tied to known assets and sponsors — a sharp contrast to the long fundraising cycles and uncertainty in primaries.

Many of the same institutions that once focused almost exclusively on the primary market — committing to blind-pool real estate funds — are now turning to secondaries. Why?

· Liquidity discounts: Buying fund stakes or recapitalisations at 10–30% below net asset value.

· Speed: Capital in secondaries is put to work immediately in existing portfolios, versus waiting 18–22 months for a primary fund to close and deploy.

· Selectivity: Investors can choose exposure to known assets and sponsors (developers, owners, managers) rather than betting blind.

This shift means the secondary market is no longer niche. It has become a mainstream allocation strategy for the very investors who once drove the primary market.

Figure 2. Secondary Market: Capital vs. Product (2020 vs 2025)

M&A Stalemate in Europe

Real estate M&A across Europe has also struggled. In 2024, total deal value was about €31bn, compared with a 10-year average of ~€50bn, according to ING. S&P Global data shows that the number of European real estate acquisitions dropped to just over 200 in 2023, from more than 300 in 2022. Closings now often take 12 months or longer, versus 6-9 months pre-2020.

Figure 3. Europe: Fundraising vs. M&A Volumes (2020 vs 2025)

Figure 4. Europe: Closing Timelines (Funds vs. M&A Deals, 2020 vs 2025)

Realities from the Brokerage Floor

Agents are reporting the same slowdown on the ground:

- The Drooms Real Estate Trends Report 2024 shows European transactions now take on average 342 days, with 70% of professionals confirming deals are slower than ever (Drooms).

- BNP Paribas Real Estate reports that while €76.7bn of CRE was invested in H1 2025, cross-border deals and office assets remain slow due to regulatory and financing hurdles (BNP Paribas).

- Savills highlights that bid-ask spreads remain wide, forcing some assets to sit "stale" on the market until repricing occurs (Savills).

The Broader Investor Universe

It's not just funds anymore:

- Family offices are writing direct €10-100m checks.

- Sovereign wealth funds (e.g., GIC, ADIA) lean on co-investments and recapitalisations.

- Insurers have tilted into real estate debt.

- Wealth platforms now channel retail investors into semi-liquid property products.

So even as the fund count shrinks, the number of channels chasing each euro has widened.

The New Reality

- Funds: Scarcity of LP capital → longer closes.

- Secondaries: Abundance of capital → three euros chasing one but return demands remain above 15% net.

- M&A: Delays and deal drought until valuations reset.

Closing Line

If 2020 was the era of "capital abundance," 2025 is the era of "capital mismatch."

"For every euro seeking a home in a new real estate fund, there are fewer doors to knock on. But in the secondary market, every euro of opportunity has three euros banging at the gate," Bloomberg reported this week, citing Jefferies data.

Conclusion: Dry Capital's Role

Dry Capital positions itself squarely in the space where capital demand is most acute and most attractive: secondaries and recapitalisations. As investors hesitate on new blind-pool commitments, we are sourcing fresh equity tranches and recapitalisation solutions for AAA-grade developers and owners across Western Europe. This means:

- Providing liquidity to GPs and sponsors through secondary transactions when fundraising stalls, whether for new deals or existing structures.

- Backing recapitalisations or refinances that stabilize high-quality projects caught in the refinancing gap.

- Channeling capital to Europe's best-in-class developers and owners, ensuring assets stay funded and can be repositioned or grown.

In short, while the market grapples with mismatched euros - too few in primaries, too many in secondaries - Dry Capital is working to build the bridge. We match patient capital with proven operators, ensuring that every euro finds its most productive home.